GAP coverage, also known as Guaranteed Asset Protection or Guaranteed Auto Protection has been available to consumers and lenders since the early 1990s. However, due to the current economic conditions its benefits to consumers and lenders have never been more crucial than it is now. There are many reasons for loan officers to consider making GAP a recommendation to their borrowers.

What is Guaranteed Asset Protection (GAP)?

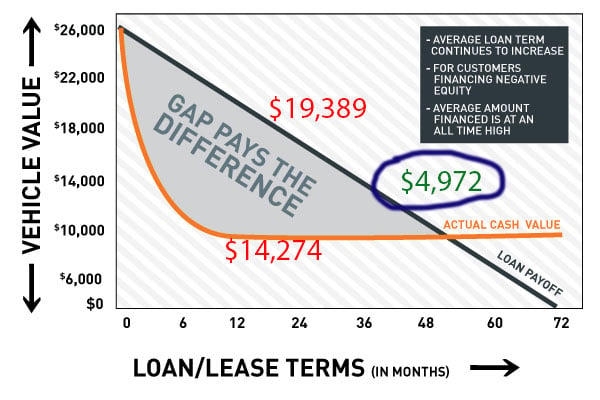

Let’s start by defining why GAP is needed. Standard auto insurance policies cover the depreciated value of a car—in other words, a standard policy pays the current market value of the vehicle at the time of a claim. In the event of an accident and the vehicle is totaled or a theft, gap insurance covers the difference (up to a stated limit) between what a vehicle is currently worth (which standard insurance will pay) and the amount a borrower actually owes on it. This is valuable for the borrower and the lender.

The advantages to the borrower in having Guaranteed Asset Protection are evident when negative equity exists. Lenders benefit by realizing increased ancillary income (in most states you can add on a lender fee to the GAP cost) and lower loss exposure. Most GAP plans also cover the borrower’s deductible, and some offer an additional payment after a GAP claim occurs if the borrower finances a replacement vehicle with you which increases customer retention.

Current statistical data suggests that GAP programs are more valuable now than ever before.

Here are some of the most telling statistics:

- The average monthly payment is $550.00 for a new car, $393.00 for used and $452.00 for leased vehicles.

- Overall, Americans owe more than $1.2 trillion in auto debt.

- Auto debt makes up 9.5% of American consumer debt.

- On average, Americans take out about $51 billion in 2.3 million new auto loans per month.

- Americans borrow an average of $32,480.00 for new vehicles and $20,446.00 for used autos.

- Allowable LTV limits have now reached 120% or more.

- The average new auto loan term is now over 70 months and 65 months for used autos.

- In mid-April, wholesale used-vehicles values dropped approximately 12%.

Term lengths and loan amounts are expected to continue to rise in the coming months and used auto values have declined as the economy struggles to rebound from the pandemic. This means GAP amounts are on the rise.

When financing an auto loan for a borrower it is important for a lender to recognize when it makes sense to recommend GAP coverage. In general, you should try to identify when the amount owed may be close to or greater than the value of the vehicle. Here are some of the most common situations borrowers find themselves in where a lender should consider recommending GAP coverage:

- Borrowers who financed their vehicle for 5 years or more.

- Borrowers who bought a vehicle that decreases in value faster than other vehicles.

- Borrowers who made down payments on their vehicle of less than 20%.

- Borrowers who drive at higher than normally accepted mileage rates.

- Borrowers with negative equity on their trade-in.

Read our article: Frequency and Size of Auto VSI and GAP Claims Remain High

As the data shows, there are more vehicle loans with negative equity than ever before. Now could be the time borrowers and lenders need GAP Protection the most. Here is an illustration of how GAP works. A the time a vehicle was totaled, the borrower owed $19, 389 but the it was only worth and insured for $14, 274, leaving a gap of $4,972 for the lender and the borrower to deal with. This was an actual claim that was paid by our GAP product. Read on to find out more about the benefits of GAP protection for both the borrower and the lender.

Benefits of GAP coverage for borrowers, lenders, and dealers:

Borrower Benefits

- Saves money by reimbursing the insurance deductible (up to $1000) when a deficiency balance remains after a total loss

- Eliminates most of the risk of negative equity for the borrower

- Can give instant equity with $1000 for a replacement vehicle when financed by the same lender

Lender Benefits

- Reduces charge-offs and GAP exposure allowing more loans to be made

- Prevents negative interaction with borrowers due to deficiency loan balances

- Can promote customer retention by providing $1,000 toward a replacement vehicle

- Generates fee revenue

Read our article: Auto Warranty Products Keep Borrowers Whole While Protecting your Assets

Dealer Benefits

- Generates fee revenue by allowing markup from the lender

- Promotes customer retention by providing $1000 toward a replacement vehicle

- Prevents unfavorable interaction with customers due to negative equity situations

It's more import than ever for Lenders to have Control Over Gap Waivers they Finance. Unitas Financial Services can help you explore asset protection solutions like GAP to help keep your borrowers and your bottom line whole.

Sources: LendingTree.com, CarandDriver.com, MarketWattch.com